Trust Foundations: Reliable Solutions for Your Building and construction

Trust Foundations: Reliable Solutions for Your Building and construction

Blog Article

Enhance Your Heritage With Expert Count On Structure Solutions

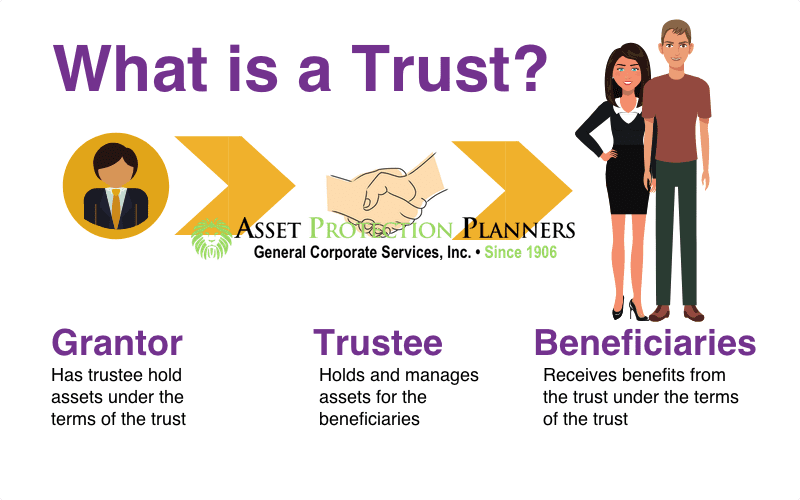

In the world of heritage preparation, the relevance of establishing a solid foundation can not be overemphasized. Professional trust structure services provide a robust structure that can protect your possessions and guarantee your desires are executed precisely as intended. From reducing tax obligation responsibilities to selecting a trustee that can properly manage your affairs, there are crucial considerations that require interest. The complexities entailed in count on structures demand a strategic approach that straightens with your long-lasting objectives and values (trust foundations). As we look into the nuances of depend on foundation services, we discover the key components that can fortify your tradition and provide a long-term impact for generations to find.

Benefits of Depend On Structure Solutions

Trust fund foundation solutions supply a durable structure for protecting assets and making certain lasting financial safety and security for people and companies alike. One of the key benefits of trust fund foundation remedies is asset security.

Additionally, count on structure services provide a tactical approach to estate preparation. Via trusts, people can outline exactly how their possessions ought to be managed and distributed upon their death. This not only helps to prevent disputes among recipients but also makes certain that the individual's heritage is maintained and handled properly. Counts on likewise provide personal privacy advantages, as properties held within a depend on are not subject to probate, which is a public and often extensive lawful process.

Kinds Of Depends On for Heritage Preparation

When considering heritage planning, a vital element involves checking out numerous kinds of lawful instruments created to preserve and distribute possessions efficiently. One typical type of count on utilized in legacy preparation is a revocable living count on. This depend on permits people to preserve control over their possessions throughout their lifetime while making certain a smooth change of these properties to beneficiaries upon their passing, avoiding the probate process and supplying privacy to the family.

Another type is an unalterable trust fund, which can not be modified or revoked as soon as developed. This trust fund supplies potential tax advantages and protects properties from financial institutions. Charitable trusts are likewise preferred for people looking to support a cause while preserving a stream of income for themselves or their beneficiaries. Special requirements trust funds are necessary for people with impairments to guarantee they obtain essential care and support without jeopardizing federal government benefits.

Understanding the various sorts of trust funds readily available for heritage planning is crucial in establishing a comprehensive approach that aligns with private objectives and priorities.

Choosing the Right Trustee

In the world of heritage planning, an essential element that demands cautious factor to consider is the option of a proper individual like this to meet the essential function of trustee. Choosing the appropriate trustee is a decision that can significantly affect the effective execution of a trust and the satisfaction of the grantor's wishes. When picking a trustee, it is crucial to focus on qualities such as trustworthiness, financial acumen, integrity, and a dedication to acting in the most effective passions of the beneficiaries.

Preferably, the chosen trustee should have a solid understanding of economic issues, be capable of making sound investment decisions, and have the capability to navigate complicated lawful and tax obligation needs. By thoroughly thinking about these variables and picking a trustee who lines up with the values and purposes of the trust fund, you can assist ensure the long-lasting success and preservation of your legacy.

Tax Obligation Implications and Benefits

Taking into consideration the financial landscape surrounding depend on frameworks and estate planning, it is paramount to explore the intricate world of tax obligation implications and advantages - trust foundations. When establishing a count on, understanding the tax obligation effects is crucial for maximizing the benefits and decreasing prospective liabilities. Depends on offer various tax obligation advantages depending upon their structure and function, such as minimizing inheritance tax, earnings taxes, and gift tax obligations

One considerable advantage of certain trust structures is the capacity to transfer possessions to beneficiaries with reduced tax obligation repercussions. Unalterable trusts can get rid of possessions from the grantor's estate, possibly decreasing estate tax liability. more In addition, some depends on allow for earnings to be dispersed to recipients, that may remain in reduced tax braces, causing overall tax cost savings for the family.

However, it is necessary to keep in mind that tax obligation regulations are intricate and subject to change, emphasizing the necessity of seeking advice from with tax obligation professionals and estate preparation professionals to ensure compliance and make best use of the tax obligation advantages of trust structures. Correctly navigating the tax obligation implications of depends on can cause substantial financial savings and an extra efficient transfer of wide range to future generations.

Steps to Developing a Trust

The very first action in establishing a trust fund is to clearly specify the purpose of the depend on and the assets that will certainly be consisted of. Next, it is essential to pick the type of depend on that finest straightens with your goals, whether it be a revocable trust, irrevocable depend on, or living depend on.

Conclusion

In conclusion, establishing a depend on pop over to this site foundation can supply numerous advantages for legacy planning, consisting of asset protection, control over distribution, and tax benefits. By selecting the appropriate sort of trust fund and trustee, individuals can secure their properties and ensure their desires are accomplished according to their desires. Understanding the tax obligation ramifications and taking the essential actions to develop a count on can help reinforce your legacy for future generations.

Report this page